He estimates that inflation will drop to 3% by mid-year but that the economy will stagnate; it is the first monetary authority, of the most important economies, to stop the rise.

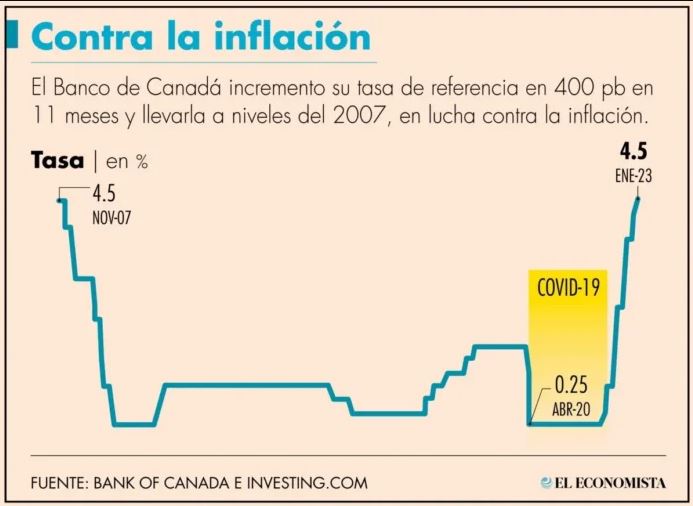

The Bank of Canada yesterday, January 25, raised its main interest rate by 25 basis points to 4.5%, the eighth consecutive increase in less than a year, in an attempt to offset inflation of 6.3% per year. This is its highest rate since 2007.

Tiff Macklem, Governor of the Bank of Canada, stated that the time has come to pause and assess whether the policy is tight enough. With this, it becomes the first, among the most important economies, to stop the rate hike for the moment.

According to the financial institution’s new forecasts, inflation is expected to drop significantly this year, after registering a rate three times higher than its target in December.

We are turning the inflation situation around (…) We are still far from our target, but the latest events reinforce our confidence that inflation is on the decline”, mentioned Tiff Macklem.

Macklem added that the bank wants to take some time to see how effective the monetary tightening is in damping the excess demand and strong labor market that have fueled inflation.

“To be clear, this is a conditional pause, if these upside risks materialize, we are prepared to continue raising rates,” he warned, acknowledging that there are upside risks to the outlook.

Royce Mendes, director and head of macro strategy at Desjardins, predicted that Macklem and his team would maintain rates for at least the next several months. “Consequently, we expect this to be the last increase in this cycle,” he said.

BoC sees recession

Canada’s approach coincides with that of the Federal Reserve, which raised its target interest rate to 4.25% over the past year. The Fed is scheduled to slow the rate of hikes at its January 31-February 1 meeting but has warned that its battle against inflation is far from over.

In its quarterly Monetary Policy Report, the bank painted a picture of a stagnant economy that could go into recession during the first half of the year, bringing inflation down to around 3% by mid-year and back to 2% until the end of the year. 2024.

ECB would maintain rate hike

Joachim Nagel and Gabriel Makhlouf, monetary policy officials at the European Central Bank (ECB), said they would not be surprised if interest rates continue to rise in the second quarter, after the two hikes scheduled for February and March.

The ECB has pledged to raise its key interest rate by half a percentage point next week to 2.5%, but policymakers expressed varying preferences for March, suggesting that the debate is wide open despite guidance for a tightening. significant amount of monetary policy at a “constant pace”.

Makhlouf said that as it stands, rates will have to go up again in March, but policymakers should “wait and see exactly what the data says.”

Nagel, president of the Bundesbank, said the ECB had already committed to raising rates sharply in the next two months. Likewise, he declared to Spiegel magazine: “I would not be surprised if we had to continue raising rates even after the two announced measures.” (Reuters)